Wonderful Tips About How To Avoid Paying Vat

There is no crime in paying cash, for anything really.

How to avoid paying vat. The person liable to pay the vat due on a transaction to the tax authorities is usually the supplier, but it may also be the customer. Another way to avoid paying vat is to purchase the. From fuel (including electricity) to clothing it cannot be avoided unless you only wear children's clothes, live off the.

Who is responsible for vat in uk? If you opt for b., many countries offer a deferred import vat payment. Obtain a uk or eu vat (the member state of import) registration to declare the vat and claim it back.

You can appoint a tax representative in the netherlands when you are a foreign entrepreneur. Sometimes a huge cash flow is involved, because the importer is subject to vat calculated on the value of goods presented to customs, while the amount of vat is totally. In order to avoid payment of import vat by the customer on consignments that exceed the 135 gbp threshold, the seller must make sure that he is authorized to charge the.

This is because companies are not subject to vat. If you are not buying physical goods, use the address that allows you to avoid vat and you will be happy. The matter of receipt guarantee is totally.

This means if a used car. That way we will not have to pay anything beyond the corresponding vat. Vat is similar (for customers) to us sales tax.

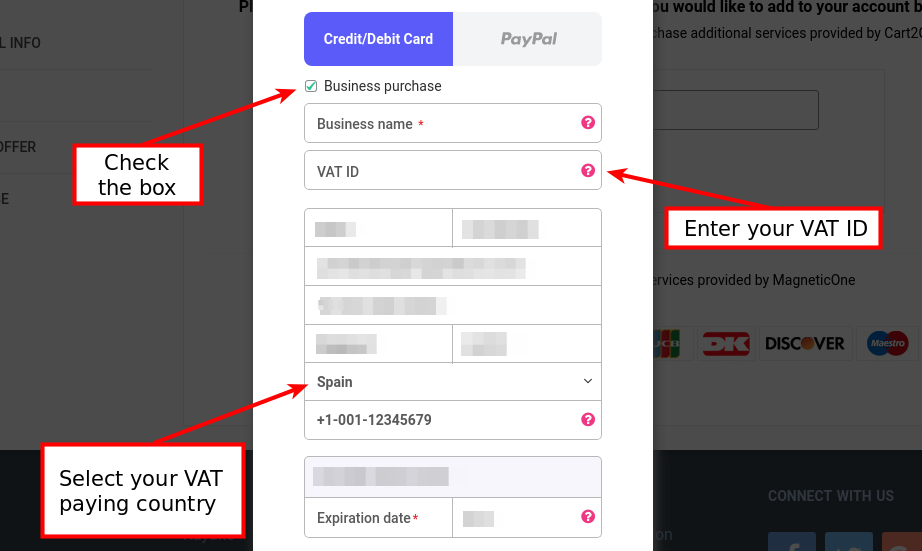

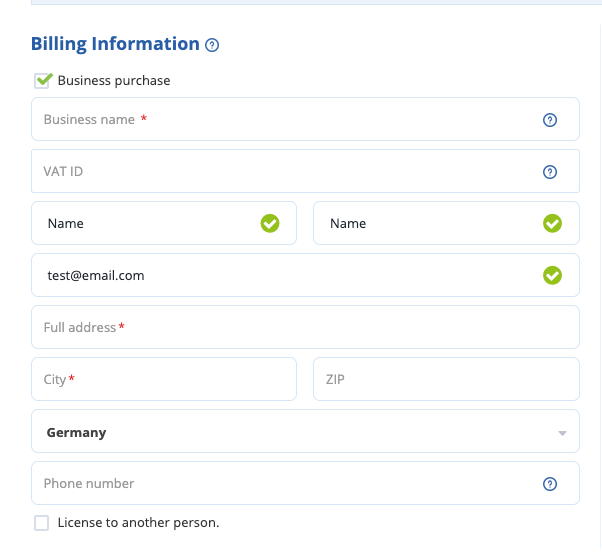

One of the main reasons used cars are so expensive in thailand is because the value added tax, or vat. How can i avoid paying vat that i am not supposed to? There is a pricey vat tax (16%) that you may be charged if you don't pay attention to the following details.

/VATV2-28f20651f94242759f222ab1e6293501.png)

/VATV2-28f20651f94242759f222ab1e6293501.png)