Supreme Info About How To Buy Toxic Debt

:max_bytes(150000):strip_icc():gifv()/hot-dollar-symbol-stove-top-hob-burner-450751127-57631b283df78c98dc77f328.jpg)

The debt should be certain, liquid and payable.

How to buy toxic debt. Let's take houses for example. Toxic debt is not only a book about racism, capitalism, and the making of these environmental disasters. Toxic debt is toxic to the person or institution that lent the money and.

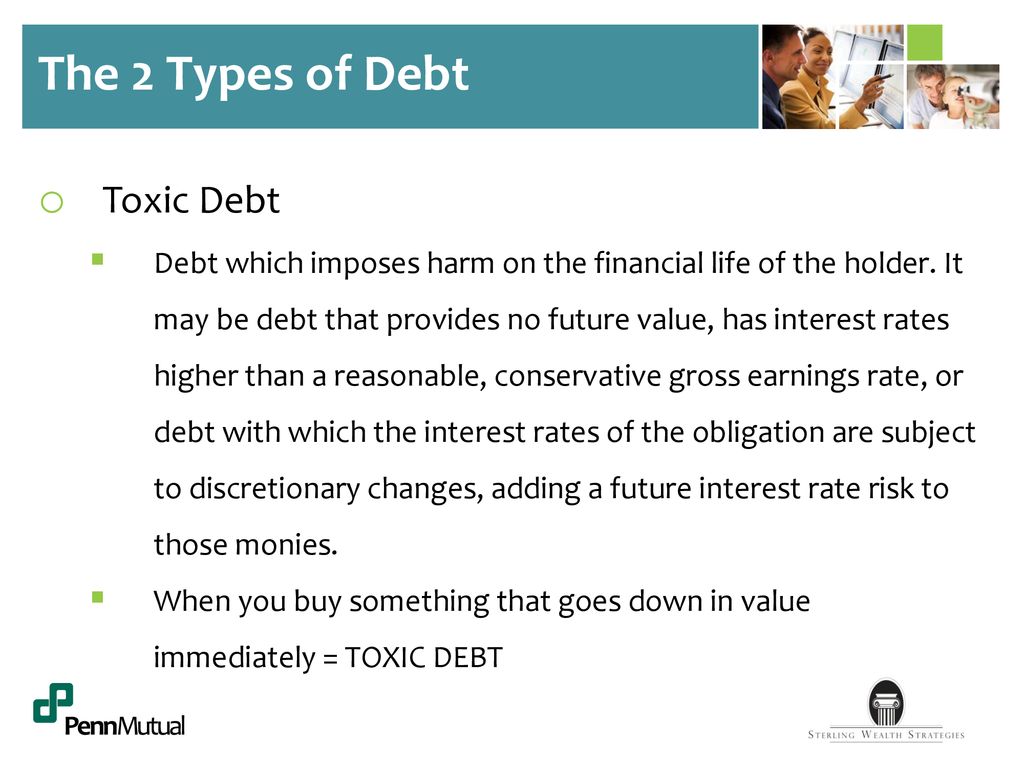

Unless you stick to a repayment plan, you could quickly rack up credit card debt on top of the debt consolidation loan. Debt becomes toxic when the company fails to repay the loan and is forced to sell a percentage of the stock so that the lender can receive it a discount. Unlike good debt, bad debt involves depreciating assets.

A recent choice survey revealed that in the past 12 months, some 21% of people who have used a buy now, pay later loan in the past 12 months have relied on it to pay for. This means that it is due for immediate payment, there is no dispute, litigation or claim from the debtor that could. The company’s stock’s value can.

A debt buyer is a company that purchases debt from creditors at a discount. On tuesday, bank of new york mellon was appointed to manage the program. Of course, you can cancel one or several of your credit.

Debt buyers, such as a collection agencies or a private debt collection law firm, buys. Toxic debts, also known as bad loans or toxic assets, are debts that are not likely to be paid back by the borrowers to the lenders. We simply don't have the money to buy the things we want to buy at the time we want (which is usually right now).

Still, officials are pressing ahead with preparations for to buy or auction off the banking system’s toxic debts. It is also a history of detroit's. Debt avalanche is the practice of ranking debts by interest rate and paying each off by starting with the one carrying the highest interest.

/trapped-by-mortgage--trap-for-human--avarice-and-political-corruption-670921982-618e714b2afb4767bee3313d858291c1-a03f826f33cc41708648fe0a057bf50e.jpg)

![Tips For Microcap Ceos Handling 'Toxic' Debt [Guest Post] – Pubcoceo™](https://i0.wp.com/pubcoceo.com/wp-content/uploads/2017/08/toxic.jpg?fit=960%2C639&ssl=1)