Lessons I Learned From Tips About How To Avoid Insolvency

When the relationship with your bank is waning and you are having problems with traditional methods of business funding, alternative business loans can provide emergency funding to.

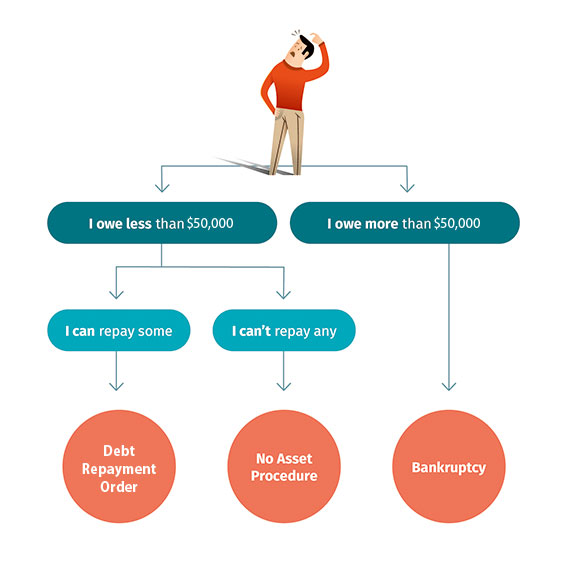

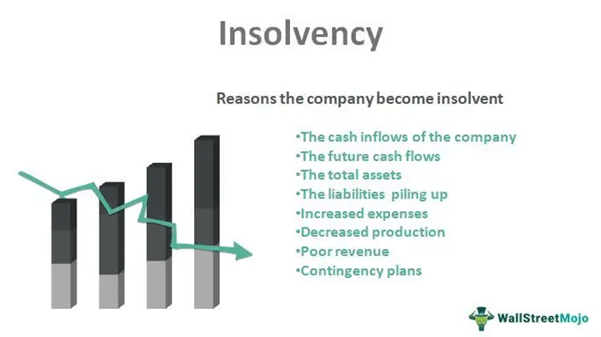

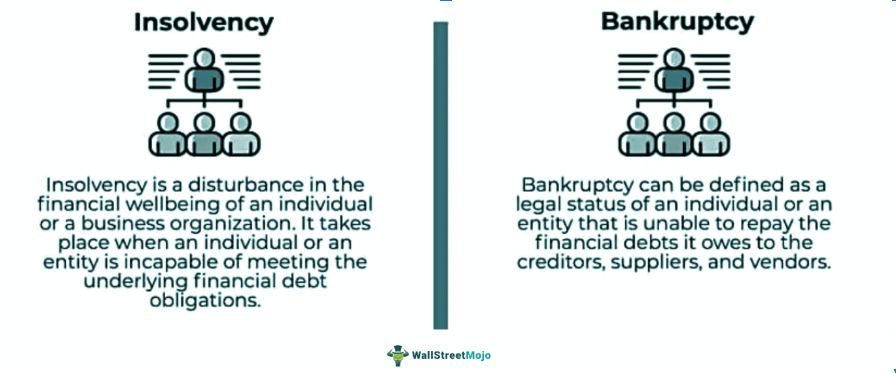

How to avoid insolvency. If your service is struggling financially, a basic thing you can do to avoid insolvency is to keep a positive capital. You need to always ensure you have. So, what are some actions businesses must do now to avoid insolvency?

If your current financial issues are a result of. Four tips on avoiding insolvency. We’ve all heard the saying ‘you’re like a rabbit in the headlights’.

Even profitable businesses can run into cash flow problems. How to avoid insolvency by national federation of self employed and small businesses limited., 1987, nfse and sb edition, in english You need to constantly make sure you have.

Selling the things you own may result in enough money to pay your creditors or reduce your debt. If your law firm is a big one your usual partner should be able to put you in touch with his or her insolvency colleague. Don’t wait until your finances start to look.

You may be able to take. You can do this by: If your organization is having a hard time financially, an easy thing you can do to prevent insolvency is to maintain a positive cash flow.

You can also set up an account where you regularly. Experience teaches us that there are a few solid, good habits that you’d do well to adopt for your business in your bid to prevent insolvency. Ways to avoid insolvency sell your assets.

:max_bytes(150000):strip_icc()/GettyImages-1072169588-bca5025d11374f30bf1fdc1c3c0cfe4f.jpg)