Fine Beautiful Tips About How To Apply For Disabled Road Tax

You will need to change the tax class of the vehicle by taking your:

How to apply for disabled road tax. You would need to send the same as above but rather than a cheque you can send proof of payment or a covering letter saying when you paid. • the person with the illness or disability • someone who uses their vehicle only for the. If you don't qualify for a full exemption, you could still get a 50% reduction in the cost of your vehicle tax if you get the standard rate mobility component of personal.

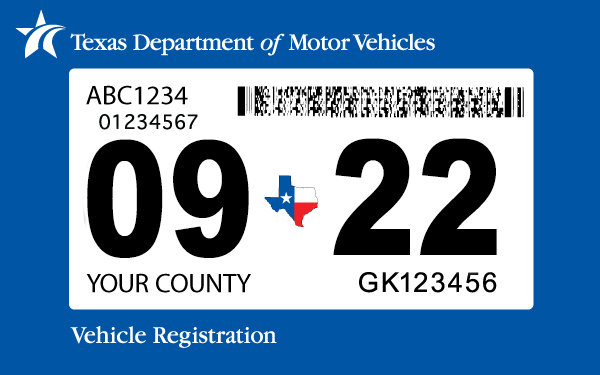

Certificate of entitlement (see list above) v5c (log book) vehicle registration certificate or v5c/2 (new keeper's details). Search our pages to find out what. You must send the following.

Dmv.org has compiled the information you need to apply for a disability placard or license plate in your state. Property tax advises and assists county revenue officials, county commissioners, and boards of equalization with administering property taxes. Apply online for a replacement title;.

Online at www.gov.uk/vehicletax (not available for afip customers) by phone on 0300 1234321 (not available for afip customers) by textphone on 0300 790 6201. Disabled veterans can apply for this tax break to reduce the assessed value of their primary residence by up to $40,500 for 2022. Your car was previously used by a disabled person

You must send the following documents:. The only way to obtain the disability road tax reduction is by sending the appropriate paperwork to dvla, swansea, sa99 1bf. Vehicles that receive the 50%.

Change your car’s tax class to or from ‘disabled’ you may need to change your vehicle’s tax class , for example if either: How to apply for free disabled tax. Who can apply for free vehicle tax.